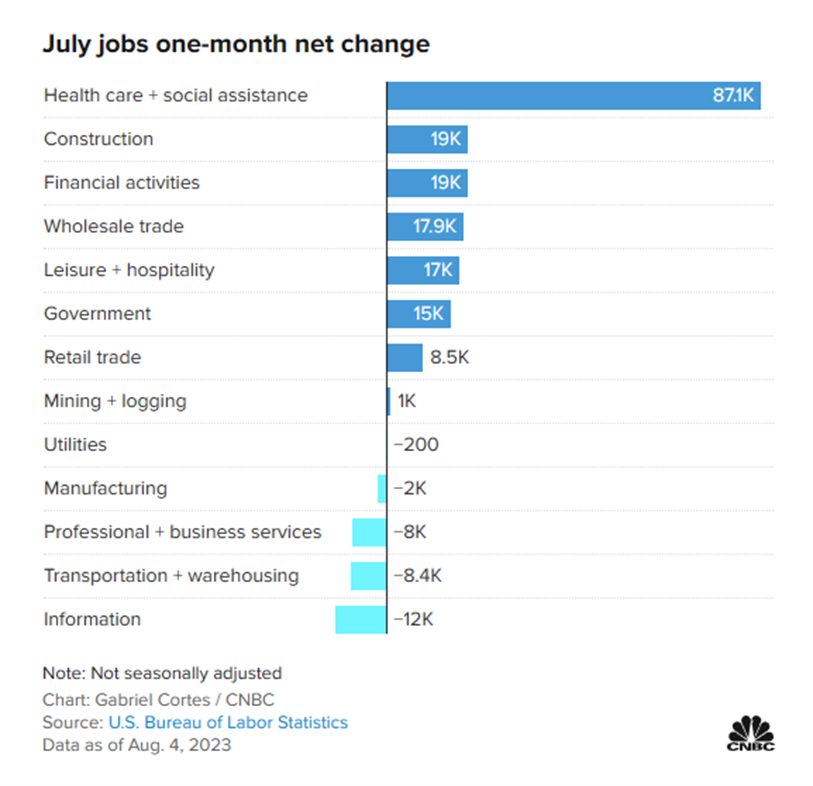

We pause our current blog series on Artificial Intelligence and Healthcare with breaking news on the recent U.S. Jobs Report issued on Friday August 4, 2023, by the U.S. Bureau of Labor Statistics[i] (BLS). As the headlines of CNBC[1]noted, “The healthcare and social assistance category grew by 87,100 jobs last month, according to the Labor Department. That total jumped to 100,000 when including education jobs, as some economists do.”

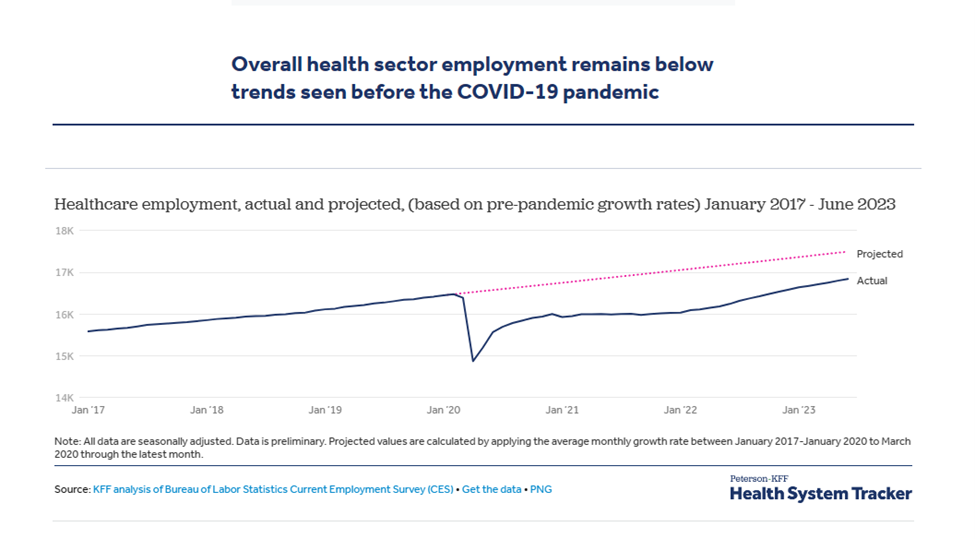

As we begin to re-stabilize to a new normal, now just over three (3) years from the beginning of the COVID-19 pandemic, we find healthcare jobs remain severely contracted as many doctors who were forced to close or severely limit their operating hours of service remain closed and the staff displaced as a result are either unemployed, re-employed, or switched careers. BLS is still attempting to document the millions that are left in healthcare. In the chart below, from a report of KFF (formerly KFF and Peterson Center), we see that Healthcare remains below trendlines in an age when we would intuitively expect the trendlines to be going further up. On average, 10,000 Baby Boomers reach age 65 daily, this eventually results an additional “load” on the healthcare system due to age-related conditions.

According to KFF:

The COVID-19 recession was markedly different – as lockdowns spread across the country, health sector jobs fell sharply along with jobs in other sectors. Even so, health sector employment did not fall quite as steeply as jobs in the rest of the economy. In April of 2020, health employment fell to 14.9 million from 16.2 million in 2019 (by -8.2%), while non-health employment fell by -14.0%. Total health employment in February 2020 was 16.5 million.

After this unprecedented drop at the beginning of the pandemic, jobs in both the health and non-health sectors sharply rebounded. Employment had begun to rise in both sectors by May 2020. While the pandemic recession is over, recovery was incomplete. The health industry had reported 95% of pre-pandemic job numbers by July of 2020, but non-healthcare jobs did not return to 95% of pre-pandemic levels until almost a year later in June 2021.

As of June 2023, the health sector added 41,100 jobs over the previous month. Jobs in the health sector are 2.2% higher than in February 2020 (the previous peak), compared to 2.6% in all other sectors.

What does all this mean? It means that prior to the COVID-19 pandemic, healthcare in the U.S. was growing rapidly needing to add clinical staff, infrastructure, and technology – COVID-19 has put all of that on steroids! This is one of the factors that continues to cause the analyst to point to healthcare as a ‘mistake proof’ investment. The forecast mid-COVID, and before many of the issues driving growth faster were identified, the previous forecast was for a CAGR of 6% to 7%. Based on our view of the State of the Union in healthcare, those numbers will come up substantially when the next forecast is completed.

Then in July, we saw something that may denote a new growth trend. The gap, caused by those that left healthcare due to burnout/severe stress and long working conditions, has clearly exacerbated an already delicate balance. However, the new growth trend appears to be the educational institutions that have stepped up in the training of more people, more physicians, more nurses, and other needed clinicians. In the link below[2], we can see that America’s Medical Schools are responding to the demand. In 2019, we had 91,225 students in Medical School. Today, we have 96,520 in medical school and while that number may not impress you by the magnitude, it is significant in the way medical schools operate!

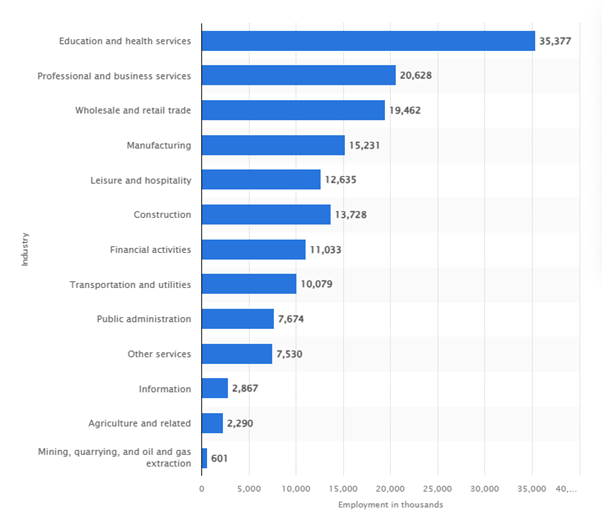

We are still projected to have shortage of over 100,000 physicians in 10 years, at which time we will have a record number of Americans over the age of 65. One of the things that continues to fascinate me, that most Americans do not understand, is that healthcare is the nation’s largest industry. Not only is the U.S. Healthcare the largest segment of Gross Domestic Product (GDP), but it is also the largest employer by a huge margin – especially considering the ancillary industries that are needed to support all of the consumer services provided by healthcare. All these other industries and companies continue to expand right along with healthcare! See graph below from Statista[3] .

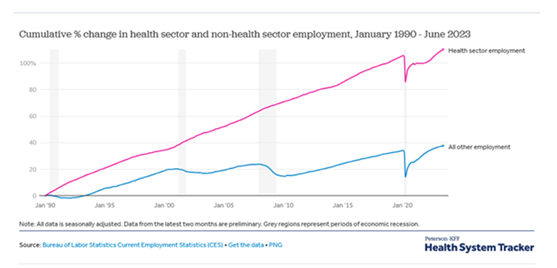

I transitioned my career from real estate development and construction into healthcare in 1988, as an angel investor. After diving in completely in 1990, I never left. I have been stunned by the organic growth in healthcare projected though 2030 when I realized that the growth was more than 10,000 people per day turning age 65 and Medicare eligible. We are now living on the leading edge of that explosive growth. The graph below is all you need to see today to understand what is behind these statements. This growth will continue for another solid 10+ years, and this is why we feel so strongly that to improve the quality of care and manage cost, we need to employ better, deeper, and smarter use of technology at every level of healthcare, as well as make better use of our clinical personnel. We need to move out of the 1940’s in the way medical personnel were used, and bring them and technology into the present.

Have you ever seen a more consistent and strong growth trend as you would expect the healthcare contribution to GDP, not to mention the gross revenue in healthcare services and equipment to align right along the healthcare line?

Healthcare is complicated and very hard to understand – far more so than any other industry I know, certainly more than construction and development. The typical business metrics don’t work the same in healthcare as in other industries. In no other industry does the payer of the services differ from who receives the services, but they do in healthcare. Healthcare is the ONLY industry that is supply driven, not demand driven. The more MRI’s available, the more MRIs per capita will be done. Since the 1960s, the U.S. government has set rates for Medicare and Medicaid that are closely monitored by private insurance.

We have witnessed an incredible transition from fee-for-service payments to capitated, managed care, and managed cost that only a decade ago many said would never happen. Once you adjust for inflation, doctors’ reimbursements have been going down for 20 years in a real dollar basis. Perhaps a signal of some awakening at the Department of Health & Human Services/Centers for Medicare & Medicaid this year. For the first time in 20 years, Medicare increased gross payments, and although by less than 1%, they reversed a 20-year trend!

However, with all that said, the growth in business opportunity for those who understand that with higher quality, you will have lower cost due to improved patient outcomes. Those who understand the critical Added Value that technology has in healthcare today are the ones that will have a very bright future!

-Noel J. Guillama, Chairman

[1] https://www.cnbc.com/2023/08/04/heres-where-the-jobs-are-for-july-2023-in-one-chart.html

[2] https://www.aamc.org/media/6101/download?attachment

[3] https://www.statista.com/statistics/200143/employment-in-selected-us-industries/