In Part 1 of our new blog series, The Economics of Healthcare – Recession, we addressed what I see as the macro of healthcare economics, and its several roles in the U.S. economy.

In Part 2, I want to respond to some of the issues and questions posed from the previous blog. The Bureau of Economic Analysis will announce when the U.S. has entered or departed a recession, and generally their rule is two consecutive quarters of contractions of Gross Domestic Product (GDP). Unfortunately, for those of us with the patience of a gnat, the indicators that largely make up these numbers are lagging by roughly a quarter; therefore, we will not know their 2nd quartered GDP “Advanced Estimate” until July 29, 2022[1].

However, growing up in the real estate and construction business, my father taught me that we could ‘feel’ the recessions coming well ahead of most. Expectations seem to be growing every day to know if the U.S. is in a recession or on the cusp; however, the entire developed world is in the same position. See reference to Bank of England headline[2] “Bank of England’s Bailey warns global economic outlook has ‘deteriorated materially’.” As we print this, interest rates have dropped in the last two weeks and commodity prices in general are down nearly 20% (more on that later).

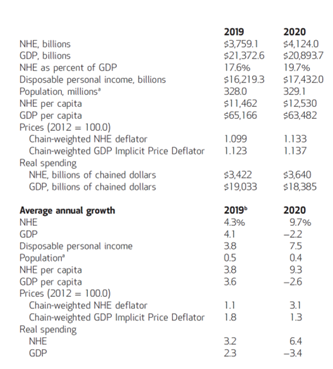

Why is all this relevant? Well, because I know that things will bounce back and we will find a normality eventually. While time has been immemorial, healthcare, in the meantime, continues to march forward. At the beginning of the COVID-19 locks downs in U.S., even I wondered if that growth trend of healthcare relative to GDP would be broken. I think I expressed those concerns in the early summer of 2020. It was hard to see then how much money would be spent on healthcare. The reality is that healthcare exploded in 2020, as well as 2021 (we’ll discuss next). As reported by Health Affairs magazine, on compiled data by The Center for Medicare and Medicaid, and released in April of 2022, the fact was that National Health Expenditures in the United States increased in 2021 by staggering 9.7%, for a total of US$4.1 trillion, and 19.7% of U.S. GDP.

Someone said, ‘that is great information but what does that mean for healthcare and the economy?’ Well, my answer has been as published before, the United States has become a healthcare-driven economy. As for proof, note that healthcare employs more people than any other industry, and healthcare is the largest component of GDP in U.S. Perhaps even more relevant is to realize the external contribution healthcare has in large industries like real estate, banking, finance, and now technology. Over the next decade, healthcare will continue to grow. It seems like some on “Wall Street” are finally taking notice and are beginning to report on the ‘sturdiness’ of healthcare during recessionary times. Below is a graphic representation of Standard and Poor’s 500 index stocks categorized by sectors and industries. Size of the square for company represents the market capitalization. This if for the first six (6) months of 2022. You will clearly see the nearly total dark green in Energy, lots of green in Utilities, and some green in aerospace and defense stocks; however, relative to the size of the industry, “healthcare” did quite well.

With so many macro issues from the war in Ukraine, it is impossible to predict what will happen to not only “energy,” but also the continued march toward renewable energy and deliberate tightening of production. Today, oil prices are just below US$100 per barrel. It is also a fact that nearly every segment of the S&P 500 went up in what some are calling the “bubble of everything in 2021.” Based on the demographics, it is easy to predict that healthcare as a total industry will be guaranteed to keep going up for years to come.

More on the economics of healthcare when we look at 2021 healthcare expenditures. If there is a magic solution in healthcare, it is the better use of technology, and technology solutions is more than “medical devices” as noted in the graphics above.

-Noel J. Guillama, President (credentials: https://www.linkedin.com/in/nguillama/)

[1] https://www.bea.gov/news/schedule

[2] https://www.cnbc.com/2022/07/05/bank-of-england-global-economic-outlook-has-deteriorated-materially.html